FSA and HSA Eligibility for Ceretone

Discover the financial benefits of using a Flexible Spending Account (FSA) or Health Savings Account (HSA) to manage your medical expenses. These accounts allow you to utilize pre-tax dollars, often deducted from your paycheck, for a variety of healthcare costs. With tax advantages and annual contribution limits, FSAs and HSAs provide a convenient way to cover unexpected medical expenses and essential healthcare items.

Ceretone Hearing Aids: FSA and HSA Eligible

You can use your FSA or HSA funds to purchase Ceretone OTC hearing aids. However, please note that hearing aids are not eligible for reimbursement with a Limited-Purpose Flexible Spending Account (LPFSA) or a Dependent Care Flexible Spending Account (DCFSA).

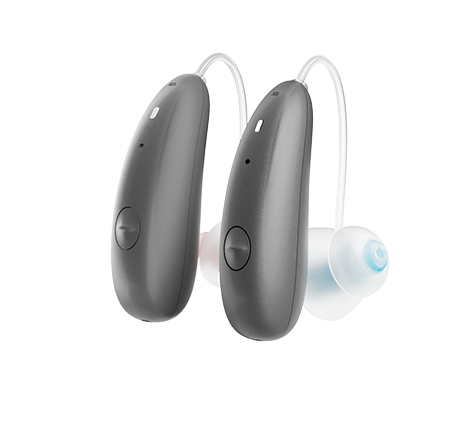

Traditional hearing aids can be a significant financial investment. At Ceretone, we prioritize accessibility and affordability by offering high-quality, over-the-counter (OTC) hearing aids that are budget-friendly. You can conveniently use your HSA or FSA card to make your purchase, making it easier than ever to invest in better hearing without a hefty price tag.

Am I Eligible for FSA/HSA?

To determine your eligibility and understand what your policy covers, it is recommended to verify your insurance coverage with your provider in advance.

Utilizing Your FSA/HSA Account for Hearing Aid Purchases

To buy hearing aids using your FSA or HSA account, treat the expense as you would any other qualified medical cost. With an HSA card, you can directly charge the purchase. Ceretone supports payments with all HSA credit and debit cards, ensuring a hassle-free experience.

Insufficient Funds in Your FSA/HSA?

If your FSA or HSA balance isn’t sufficient to cover the cost of hearing aids, consider talking to your plan administrator about increasing your contributions. These funds are deposited tax-free, allowing you to still enjoy significant savings on your hearing aids.

If you do not have access to a debit card, you can still get reimbursed for your purchases by submitting receipts to your insurance company or employer. This money is your own, kept in an external account, ensuring no disagreements over reimbursement amounts for eligible expenses.

Understanding FSA and HSA Accounts

If you have employer-provided health insurance, you might have access to an FSA or HSA account. These accounts allow you to save pre-tax money for out-of-pocket medical expenses, including hearing aids. Contributions are tax-deductible or pre-tax, and any interest earned is tax-free. FSAs and HSAs enable you to pay for current healthcare costs and save for future expenses.

Purchasing with Confidence

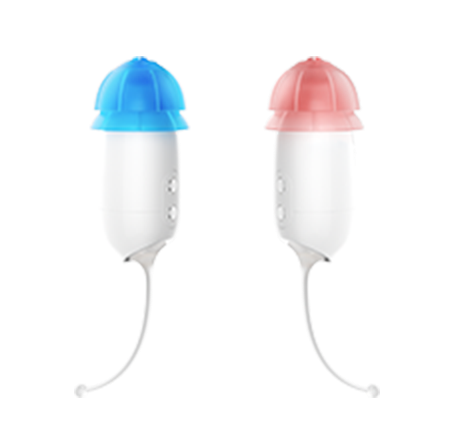

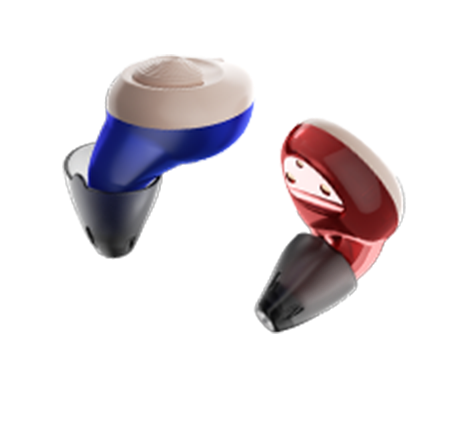

Ceretone provides affordable OTC hearing aids designed for both convenience and comfort. Should you encounter any issues with your hearing device, our dedicated customer service team is here to assist you with top-notch support.

If you are not fully satisfied with your purchase, Ceretone offers a 60-day money-back guarantee. Regardless of whether you used an FSA/HSA card, you will receive a complete refund. If your FSA/HSA card expires after the purchase, we will process the refund via check.

Purchase Your Ceretone Hearing Aids with Your FSA/HSA Account

Have more questions about your eligibility? Speak to a Ceretone Representative today at (1-866-283-4262).